A tool that calculates the Compound Annual Growth Rate of an investment over a specified period.

Initial Investment

Final Investment

CAGR

{{ $filters.formatCurrency(this.initialInvestment) }}

{{ $filters.formatCurrency(this.finalInvestment) }}

{{ this.cagr }}%

CAGR Calculator: Compounded Annual Growth Rate

Introduction to CAGR

Investing can be a daunting task, especially when it comes to measuring the growth of your investments over time. One powerful tool that simplifies this process is the Compound Annual Growth Rate (CAGR) calculator. But what exactly is CAGR, and why is it important for investors?

What is CAGR?

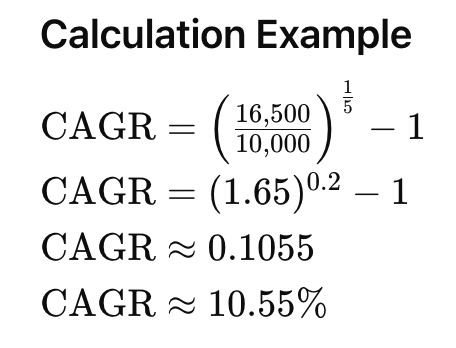

CAGR stands for Compound Annual Growth Rate. It is a useful metric that provides a smoothed annual growth rate for an investment over a specified period. The formula for calculating CAGR is:

Where:

- Vf = Final value of the investment

- Vi = Initial value of the investment

- n = Number of years

Benefits of Using a CAGR Calculator

Accurate Growth Measurement

A CAGR calculator provides an accurate measurement of an investment’s annual growth rate, considering the effects of compounding, which can significantly affect the actual growth over time.

Simplifying Complex Calculations

Manually calculating CAGR can be complex and prone to errors. A calculator automates this process, ensuring accuracy and saving time.

CAGR CALCULATION TABLE -

| Year | Investment Value | Annual Growth Rate |

|---|---|---|

| {{ row.column1 }} | {{ row.column2 }} | {{ row.column3 }} |

How to Use a CAGR Calculator

Step-by-Step Guide

-

Enter the Beginning Value:

This is the initial amount of your investment.

-

Enter the Ending Value:

This is the amount at the end of the investment period.

-

Input the Time Period:

Specify the number of years the investment was held.

Input Details Needed

Ensure you have accurate figures for the beginning value, ending value, and the exact time period. These inputs are crucial for precise calculations.

Understanding the Results

-

Interpreting CAGR Results

CAGR provides a single annual growth rate that represents the investment's performance over the specified period. A higher CAGR indicates better growth.

-

Real-World Examples

For instance, if you invested $10,000 in a mutual fund five years ago and it's now worth $15,000, the CAGR calculator helps you understand the annual growth rate.

CAGR vs. Regular Interest Rate

Regular Interest Rate

Assume a simple interest rate of 10% per year on the same initial investment of ₹10,000 for 5 years.

Comparison:

- With a regular simple interest rate, the final amount after 5 years is ₹15,000.

- With a CAGR of 10.55%, the final amount after 5 years is ₹16,500.

Conclusion:

CAGR considers the compounding effect and provides a more accurate measure of the investment's growth over multiple periods, while regular interest rate (simple interest) does not account for compounding. This results in a higher final value with CAGR as compared to simple interest.

CAGR vs. Other Growth Metrics

-

Comparison with Absolute Growth and Annualized Return

Unlike absolute growth, which simply shows the total percentage increase, CAGR accounts for the compounding effect, providing a more accurate annual growth rate. Annualized return is similar but can be less precise in some contexts.

-

Advantages of CAGR

CAGR offers a clear, consistent measure of growth, making it easier to compare different investments over varying periods.

Applications of CAGR

-

Stock Market Investments

CAGR is widely used to evaluate the performance of stocks and compare them to market benchmarks.

-

CAGR is widely used to evaluate the performance of stocks and compare them to market benchmarks.

-

Business Growth Analysis

Businesses use CAGR to measure growth in revenue, profits, and other key metrics

Factors Affecting CAGR Calculations

-

Time Period

The length of the investment period directly impacts the CAGR, with longer periods typically showing more smoothed growth rates.

-

Initial and Final Values

Accurate initial and final values are essential for precise CAGR calculations. Inaccurate data can lead to misleading results.

Common Mistakes to Avoid

-

Incorrect Data Input

Ensure all inputs are accurate and reflect the actual values to avoid incorrect calculations.

-

Misinterpretation of Results

Understand that CAGR represents an average growth rate and may not reflect yearly fluctuations.

Advanced Features of CAGR Calculators

-

Adjusting for Inflation

Some calculators allow adjustments for inflation, providing a more accurate picture of real growth.

-

Comparing Multiple Investments

Advanced calculators can compare the CAGR of multiple investments, helping you make informed decisions.

Case Studies

-

Successful Investment Examples Using CAGR

Consider an investor who used CAGR to compare mutual funds and chose one that consistently outperformed the market, leading to significant gains.

-

Lessons Learned

Learning from these case studies can provide valuable insights into effective investment strategies.

Expert Insights on CAGR

-

Quotes from Financial Advisors

Financial advisors often recommend using CAGR calculators to get a realistic view of investment growth.

-

Practical Tips

Experts suggest regularly reviewing your CAGR to stay informed about your investment performance.

Future Trends in CAGR Calculations

-

Integration with AI and Machine Learning

Future calculators may integrate AI to provide even more accurate predictions and insights.

-

Enhanced User Interfaces

User interfaces are expected to become more intuitive, making it easier for investors of all levels to use CAGR calculators effectively.

Frequently asked questions

-

-

They are highly accurate when correct data is inputted.

-

Yes, CAGR calculators can be used for stocks, mutual funds, business growth, and more

-

CAGR accounts for compounding and provides an average annual growth rate, while absolute growth shows total percentage increase.

-

CAGR is one of the best metrics for consistent, long-term growth measurement, but it should be used alongside other metrics for a comprehensive view.

Conclusion

-

Summary of Key Points

CAGR calculators are essential tools for investors, offering accurate, simplified growth measurements. They are applicable across various investment types and provide invaluable insights into performance.

-

Encouragement to Use CAGR Calculators

Start using a CAGR calculator today to unlock the full potential of your investments and make informed decisions.

-

Get a Personal Loan that fits your needs. Apply for loans from

Rs 1,000 to Rs 15 Lakhs with Lowest Interest Rates.

-

Find the Perfect Credit Card for your spending habits. Explore

Top Credit Cards and maximize your rewards every month.