A tool that helps you determine the future value of an investment or savings account by accounting for interest that is compounded over time.

Compound Interest Calculator

Principal Amount

Invested Amount

Total Value

{{ $filters.formatCurrency(this.principle) }}

{{ $filters.formatCurrency(this.totalInterest) }}

{{ $filters.formatCurrency(this.totalAmount) }}

Compound Interest Calculator

Have you ever wondered how your money could grow over time? Compound interest is the key to unlocking significant financial growth.

Acompound interest calculator is an invaluable tool that helps you project the future value of your investments and savings. It takes into account the principal amount, interest rate, compounding frequency, and time period to give you a clear picture of how much your money can grow.

What is Compound Interest?

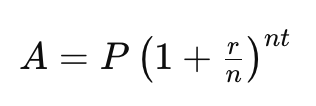

Compound interest works by applying interest to the total amount of money in your account, not just the original principal. This results in the interest compounding or growing at an exponential rate. Here’s a simple formula to calculate compound interest:

Where:

- A = the amount of money accumulated after n years, including interest.

- P = principal amount (the initial money).

- r = annual interest rate (decimal).

- n = number of times the interest is compounded per year.

- t = the time the money is invested for, in years.

Benefits of Using a Compound Interest Calculator

-

Accurate Future Value Predictions

A compound interest calculator provides precise estimates of the future value of your investments or savings, helping you make informed financial decisions.

-

Simplifying Complex Calculations

Manually calculating compound interest can be complex and error-prone. A calculator automates this process, ensuring accuracy and saving time.

-

Planning and Goal Setting

By understanding how your money will grow, you can set realistic financial goals and create a solid plan to achieve them.

How to Use a Compound Interest Calculator

Step-by-Step Guide

-

Enter the Principal Amount:

This is the initial amount of money you are investing or saving.

-

Input the Annual Interest Rate:

Enter the interest rate as a percentage.

-

Select the Compounding Frequency:

Choose how often the interest is compounded (annually, semi-annually, quarterly, monthly, daily). -

Enter the Time Period:

Specify the number of years you plan to keep the investment or savings.

Necessary Inputs

- Principal amount

- Annual interest rate

- Compounding frequency

- Time period

Understanding the Results

Breakdown of the Results

The calculator will display the future value of your investment or savings, the total interest earned, and a year-by-year breakdown of how the investment grows.

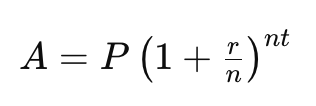

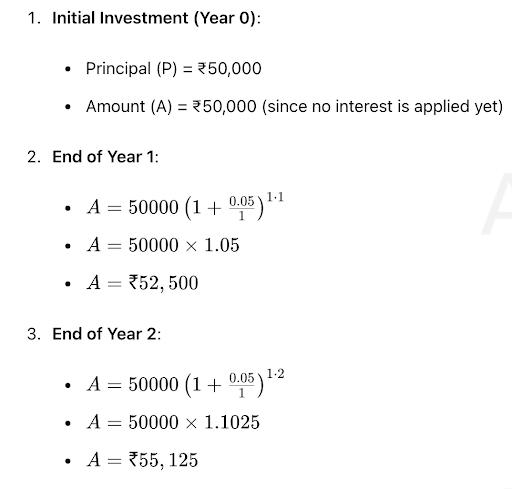

Example of Compound Interest in Investments

Let's take an example to understand how compound interest works in investments. Suppose you invest ₹50,000 in an account that offers an annual interest rate of 5%, compounded annually. You plan to keep this investment for 5 years.

Compound Interest Formula

Where:

- A = the amount of money accumulated after n years, including interest.

- P = principal amount (₹50,000).

- r = annual interest rate (5% or 0.05).

- n = number of times interest is compounded per year (1 for annual compounding).

- t = the time the money is invested for (5 years).

Calculations

Let's calculate the amount at the end of each year using the compound interest formula.

| Year | Principal | Interest Earned | Total Amount |

|---|---|---|---|

| {{ row.col1 }} | {{ row.col2 }} | {{ row.col3 }} | {{ row.col4 }} |

Conclusion

By the end of 5 years, your investment of ₹50,000 grows to ₹63,814.08 due to compound interest. The interest earned each year is added to the principal amount, allowing you to earn interest on the new, higher principal in the following years. This is the essence of compound interest—earning interest on interest, leading to exponential growth over time.

Factors Affecting Compound Interest Calculations

-

Principal Amount

The initial amount of money you invest or save significantly impacts the future value. A higher principal amount results in greater growth.

-

Interest Rate

The annual interest rate determines how quickly your money grows. Higher rates lead to faster growth.

-

Compounding Frequency

The frequency of compounding (annually, semi-annually, quarterly, monthly, daily) affects how often interest is added to the principal. More frequent compounding results in higher returns.

-

Time Period

The length of time you keep your investment or savings also plays a crucial role. The longer the time period, the more your money will grow due to compounding.

Types of Compound Interest Calculations

-

Annual Compounding

Interest is added to the principal once per year.

-

Semi-Annual Compounding

Interest is added to the principal twice per year.

-

Quarterly Compounding

Interest is added to the principal four times per year.

-

Monthly Compounding

Interest is added to the principal twelve times per year.

-

Daily Compounding

Interest is added to the principal every day

Common Mistakes to Avoid

-

Incorrect Data Input

Ensure all inputs are accurate to get precise results. Incorrect data can lead to misleading estimates.

-

Misunderstanding Compounding Frequency

Understand how different compounding frequencies affect your investment growth. More frequent compounding results in higher returns.

-

Ignoring the Impact of Additional Contributions

Regularly adding to your principal can significantly boost your returns. Consider this when planning your investments.

Expert Tips for Maximizing Compound Interest

-

Start Early and Invest Regularly

The earlier you start and the more consistently you invest, the greater your returns will be due to the compounding effect.

-

Reinvest Interest Earned

Reinvest any interest earned to maximize your growth potential.

-

Diversify Your Investments

Spread your investments across different asset classes to reduce risk and increase potential returns.

Comparison with Other Financial Tools

Compound Interest Calculators vs. Simple Interest Calculators

Compound interest calculators consider the effects of compounding, providing more accurate and higher growth estimates compared to simple interest calculators, which do not.

Compound Interest Calculators vs. Retirement Calculators

While both tools help in financial planning, retirement calculators take into account various factors like inflation, withdrawals, and lifespan, providing a more comprehensive view of retirement savings.

Real-Life Examples and Testimonials

User Experiences with Compound Interest Calculators

Many users have found compound interest calculators to be invaluable tools for planning their financial futures. One user shared how the calculator helped them realize the importance of starting early and making regular contributions.

Future Trends in Compound Interest Calculations

-

Integration with Digital Financial Tools

Future calculators may integrate with budgeting apps and financial planning tools, offering a more comprehensive view of your finances.

-

AI and Machine Learning Enhancements

AI technology could enhance calculators, providing more personalized and accurate predictions based on your financial history and goals.

Frequently asked questions

-

-

How accurate are compound interest

calculators?

They provide highly accurate estimates when correct data is inputted.

-

Yes, compound interest calculators can be used for various investments, including savings accounts, fixed deposits, and mutual funds.

-

Consider the principal amount, annual interest rate, compounding frequency, time period, and any additional contributions.

-

Start investing early, make regular contributions, reinvest interest earned, and diversify your investments.

Conclusion

Summary of Key Points

Compound interest calculators are essential tools for anyone looking to grow their savings or investments. They provide accurate predictions, simplify complex calculations, and help in setting realistic financial goals.

Encouragement to Use Compound Interest Calculators

Start using a compound interest calculator today to understand the power of compounding and take control of your financial future.

-

Get a Personal Loan that fits your needs. Apply for loans from

Rs 1,000 to Rs 15 Lakhs with Lowest Interest Rates.

-

Find the Perfect Credit Card for your spending habits. Explore

Top Credit Cards and maximize your rewards every month.