A Home Loan EMI Calculator is an online tool that helps you calculate your monthly EMI based on the loan amount, interest rate, and loan tenure.

Monthly EMI

Total Interest

Total Amount

{{ $filters.formatCurrency(emi) }}

{{ $filters.formatCurrency(interestAmount) }}

{{ $filters.formatCurrency(totalAmount) }}

Home Loan EMI Calculator

A Home Loan EMI Calculator is a powerful tool that helps you determine your Equated Monthly Installment (EMI) for a home loan. It provides an estimate of the monthly payments you need to make towards repaying your loan, enabling you to plan your finances effectively. Understanding your EMI can help you manage your budget and ensure timely repayments.

What is EMI?

EMI, or Equated Monthly Installment, is the fixed monthly payment you make towards repaying your home loan. It includes both the principal amount and the interest charged by the lender. The EMI remains constant throughout the loan tenure, making it easier for you to manage your monthly budget.

How to Use the Home Loan EMI Calculator?

Using the Home Loan EMI Calculator is simple and straightforward. Follow these steps:-

Enter Loan Amount:

Input the total loan amount you wish to borrow.

-

Enter Interest Rate:

Provide the interest rate offered by the lender.

-

Enter Loan Tenure:

Specify the loan tenure in years or months.

-

Calculate:

Click on the calculate button to get your monthly EMI.

Example Calculation

| Details | Values |

|---|---|

| {{ row.column1 }} | {{ row.column2 }} |

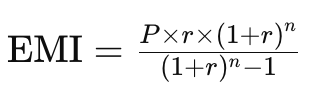

EMI Calculation Formula

The formula to calculate EMI is:

Where:

- P = Principal loan amount

- r = Monthly interest rate (annual interest rate divided by 12)

- n = Loan tenure in months

Benefits of Using a Home Loan EMI Calculator

-

Financial Planning

A Home Loan EMI Calculator is an essential tool for financial planning. By knowing your EMI in advance, you can plan your monthly budget and ensure that you can comfortably afford the loan repayments. This helps in avoiding any financial stress and ensures timely payments.

-

Compare Loan Offers

With a Home Loan EMI Calculator, you can compare different loan offers from various lenders. By inputting different interest rates and tenures, you can find the most affordable loan option that suits your financial situation.

-

Quick and Accurate Results

Manual calculations can be time-consuming and prone to errors. A Home Loan EMI Calculator provides quick and accurate results, saving you time and ensuring that you have the correct information to make informed decisions.

Factors Affecting Home Loan EMI

-

Loan Amount

The principal loan amount is one of the primary factors affecting your EMI. Higher loan amounts result in higher EMIs, and vice versa.

-

Interest Rate

The interest rate charged by the lender directly impacts your EMI. A higher interest rate increases the EMI, while a lower interest rate reduces it. It’s important to compare interest rates from different lenders to find the best deal.

-

Loan Tenure

The loan tenure is the duration over which you repay the loan. Longer tenures result in lower EMIs but higher total interest payments. Conversely, shorter tenures result in higher EMIs but lower total interest payments.

Example

Scenario: You have a home loan of ₹30,00,000 at an interest rate of 8% with a tenure of 15 years.

Calculation:

| Loan Tenure | EMI (₹) | Total Interest (₹) | Total Payment (₹) |

|---|---|---|---|

| {{ row.column1 }} | {{ row.column2 }} | {{ row.column3 }} | {{ row.column4 }} |

Understanding EMI Breakdown

-

Principal Amount

The principal amount is the original loan amount that you borrow from the lender. Over the loan tenure, a portion of each EMI goes towards repaying the principal amount.

-

Interest Amount

The interest amount is the cost of borrowing the loan, charged by the lender. It is calculated based on the outstanding principal amount and the interest rate. Initially, a larger portion of the EMI goes towards paying the interest, but as the principal reduces, the interest component decreases and the principal component increases.

EMI Breakdown Table

| Month | EMI (₹) | Principal (₹) | Interest (₹) | Outstanding Principal (₹) |

|---|---|---|---|---|

| {{ row.column1 }} | {{ row.column2 }} | {{ row.column3 }} | {{ row.column4 }} | {{ row.column5 }} |

Tips for Managing Your Home Loan EMI

-

Opt for a Longer Tenure

Choosing a longer tenure can reduce your monthly EMI, making it more affordable. However, keep in mind that this will increase the total interest paid over the loan tenure.

-

Make Prepayments

Making prepayments whenever you have extra funds can significantly reduce your principal amount and, consequently, your EMI. This can also help in reducing the overall loan tenure.

-

Negotiate for Lower Interest Rates

Always negotiate with your lender for a lower interest rate. Even a slight reduction in the interest rate can result in significant savings on your EMI and total interest paid.

-

Switch to a Different Lender

If you find a lender offering a lower interest rate than your current lender, consider refinancing your home loan. This can help you take advantage of lower EMIs and save on interest payments.

Frequently asked questions

-

-

The calculator uses the principal amount, interest rate, and loan tenure to compute the EMI using a standard formula.

-

Yes, you can input different loan tenures into the EMI calculator to see how the EMI changes with varying tenures.

-

Yes, the EMI amount remains fixed throughout the loan tenure for fixed-rate loans. However, for floating-rate loans, the EMI may change with fluctuations in the interest rate.

-

Yes, most lenders allow prepayments on home loans. Prepayments can reduce the principal amount, thereby reducing the EMI or the loan tenure.

-

Yes, most lenders allow prepayments on home loans. Prepayments can reduce the principal amount, thereby reducing the EMI or the loan tenure.

-

Missing an EMI payment can lead to penalties, additional interest charges, and a negative impact on your credit score. It’s important to ensure timely payments.

-

You can reduce your EMI by opting for a longer loan tenure, negotiating for a lower interest rate, or making prepayments to reduce the principal amount.

-

Yes, under Section 80C and Section 24 of the Income Tax Act, you can avail of tax benefits on the principal repayment and interest paid on home loan EMIs.

-

Yes, you can transfer your home loan to another bank offering a lower interest rate to reduce your EMI. This process is known as refinancing.

-

The primary factors affecting your home loan EMI are the loan amount, interest rate, and loan tenure. Changes in any of these factors will impact the EMI.

Conclusion

A Home Loan EMI Calculator is an invaluable tool for anyone considering taking a home loan or managing an existing one. It provides quick and accurate EMI calculations, helping you plan your finances better. By understanding your EMI, you can make informed decisions, compare different loan offers, and choose the best option that suits your financial needs.

Use our Home Loan EMI Calculator to get an instant estimate of your monthly installments and start planning your dream home purchase today. Whether you are a first-time homebuyer or looking to refinance your existing loan, our calculator can help you navigate the complexities of home loan EMIs with ease.

Remember, careful planning and timely payments are key to managing your home loan effectively and achieving financial stability.

-

Get a Personal Loan that fits your needs. Apply for loans from

Rs 1,000 to Rs 15 Lakhs with Lowest Interest Rates.

-

Find the Perfect Credit Card for your spending habits. Explore

Top Credit Cards and maximize your rewards every month.