A lumpsum investment is a one-time investment of a large amount of money, as opposed to making smaller, regular contributions over time.

Total Investment

Est.Returns

Total Value

{{ $filters.formatCurrency(totalInvestment) }}

{{ $filters.formatCurrency(remainingBalance) }}

{{ $filters.formatCurrency(lumpsum) }}

A Lumpsum Investment Calculator is a powerful tool that helps you estimate the future value of a one-time investment over a specified period.

It enables investors to make informed decisions by predicting potential returns based on different interest rates and investment durations. Whether you are investing in mutual funds, stocks, or fixed deposits, understanding how your lumpsum investment can grow is crucial for financial planning.

What is a Lumpsum Investment?

A lumpsum investment refers to investing a large sum of money in one go, rather than spreading it out over time through systematic investment plans (SIPs). This type of investment is ideal for those who have a significant amount of money at their disposal and want to invest it all at once to potentially earn higher returns.

How to Use the Lumpsum Investment Calculator?

Using the Lumpsum Investment Calculator is simple and straightforward. Follow these steps:-

Enter the Investment Amount:

Input the total amount you plan to invest.

-

Enter the Expected Rate of Return:

Provide the annual interest rate or expected rate of return on your investment.

-

Enter the Investment Duration:

Specify the duration of the investment in years.

-

Calculate:

Click on the calculate button to get the estimated future value of your investment.

Example Calculation

| Details | Values |

|---|---|

| {{ row.column1 }} | {{ row.column2 }} |

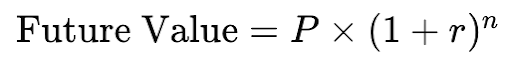

Calculation Formula

The formula to calculate the future value of a lumpsum investment is:

Where:

- P = Principal investment amount

- r = Annual interest rate (expressed as a decimal)

- n = Number of years

Benefits of Using a Lumpsum Investment Calculator

-

Financial Planning

A Lumpsum Investment Calculator is an essential tool for financial planning. It helps you estimate the future value of your investment, enabling you to plan for long-term goals such as buying a house, funding your child's education, or building a retirement corpus.

-

Compare Investment Options

With a Lumpsum Investment Calculator, you can compare different investment options. By inputting various rates of return and durations, you can determine which investment option is likely to yield the highest returns.

-

Quick and Accurate Results

Manual calculations can be time-consuming and prone to errors. A Lumpsum Investment Calculator provides quick and accurate results, saving you time and ensuring that you have the correct information to make informed decisions.

Factors Affecting Lumpsum Investment Returns

-

Investment Amount

The principal amount you invest is one of the primary factors affecting your returns. A higher investment amount typically results in higher returns.

-

Rate of Return

The rate of return is the annual percentage growth of your investment. Higher rates of return lead to greater future values.

-

Investment Duration

The duration of your investment plays a significant role in determining the future value. The longer the investment period, the higher the returns due to the power of compounding.

Example

Scenario: You have ₹5,00,000 to invest at an expected return of 10% per annum for 15 years.

Calculation:

| Investment Duration | Future Value (₹) |

|---|---|

| {{ row.column1 }} | {{ row.column2 }} |

Understanding Compounding in Lumpsum Investments

-

What is Compounding?

Compounding is the process where the earnings from an investment are reinvested to generate additional earnings. This means that the interest earned on the principal amount also earns interest over time, leading to exponential growth of the investment.

-

Impact of Compounding on Lumpsum Investments

The effect of compounding is more significant over longer investment periods. By reinvesting the returns, the investment grows at an increasing rate, maximizing the future value.

Compounding Example

Scenario: Investing ₹1,00,000 at an annual return of 8% for 10 years.

Calculation:

| Year | Principal (₹) | Interest (₹) | Future Value (₹) |

|---|---|---|---|

| {{ row.column1 }} | {{ row.column2 }} | {{ row.column3 }} | {{ row.column4 }} |

Types of Lumpsum Investments

-

Mutual Funds

Investing in mutual funds as a lumpsum allows you to benefit from the diversification and professional management of the fund.The returns depend on the performance of the underlying assets.

-

Stocks

Investing a lumpsum in stocks can potentially yield high returns, but it also comes with higher risks. It's essential to research and select fundamentally strong stocks.

-

Fixed Deposits

Fixed deposits offer a guaranteed return on your lumpsum investment with low risk. The interest rates are generally lower compared to other investment options, but they provide stability and security.

-

Real Estate

Investing in real estate as a lumpsum can offer significant returns over time through appreciation in property value. It also provides rental income, but it requires a large initial investment and comes with liquidity ris

How to Choose the Right Lumpsum Investment?

-

Assess Your Risk Appetite

Understanding your risk tolerance is crucial when choosing a lumpsum investment. High-risk investments like stocks may offer higher returns but come with greater volatility. Low-risk options like fixed deposits provide stability but with lower returns.

-

Define Your Investment Horizon

Your investment horizon should align with your financial goals. Short-term goals may require low-risk investments, while long-term goals can benefit from higher-risk, high-return investments.

-

Diversify Your Portfolio

Diversifying your investments can help manage risk and optimize returns. Consider allocating your lumpsum investment across different asset classes like mutual funds, stocks, fixed deposits, and real estate.

Frequently asked questions

-

-

A lumpsum investment calculator estimates the future value of your investment based on the principal amount, expected rate of return, and investment duration.

-

-

It helps in financial planning, comparing different investment options, and provides quick and accurate results for informed decision-making.

-

Yes, you can use it for various investments like mutual funds, stocks, fixed deposits, and real estate to estimate potential returns.

-

The principal amount, rate of return, and investment duration are the primary factors affecting the returns on a lumpsum investment.

-

Compounding allows your investment to grow exponentially by earning interest on the interest, leading to higher returns over time.

-

A lumpsum investment is suitable for those who have a significant amount of money to invest and are comfortable with the associated risks. It’s important to assess your risk tolerance and investment horizon before investing.

-

Risks vary depending on the type of investment. High-risk options like stocks can be volatile, while low-risk options like fixed deposits offer stability but lower returns.

-

You can maximize returns by choosing investments with higher rates of return, having a longer investment horizon, and diversifying your portfolio to manage risk.

-

Get a Personal Loan that fits your needs. Apply for loans from

Rs 1,000 to Rs 15 Lakhs with Lowest Interest Rates.

-

Find the Perfect Credit Card for your spending habits. Explore

Top Credit Cards and maximize your rewards every month.