A pension calculator is an online tool that helps you estimate the amount of money you need to save for retirement by projecting the future value of your savings based on your inputs.

Pension Calculator

Monthly Pension

Total Investment

{{ $filters.formatCurrency(pension) }}

{{ $filters.formatCurrency(totalInvestment) }}

Pension Calculator Online

A Pension Calculator is a powerful tool that helps you estimate the amount of money you will need to save for a comfortable retirement. By inputting variables such as your current age, retirement age, monthly savings, and expected rate of return, you can get a clear picture of your future financial situation. This allows you to make informed decisions about your retirement planning and ensure a financially secure future.

What is a Pension?

A pension is a retirement savings plan that provides a steady income stream to individuals after they retire from work. It is designed to ensure financial security during the retirement years, allowing individuals to maintain their standard of living. Pensions can be either employer-sponsored or personal retirement plans, and they can be funded through regular contributions or one-time lump sum investments.

How to Use the Pension Calculator?

-

Enter Your Current Age:

Input your current age.

-

Enter Your Retirement Age:

Specify the age at which you plan to retire.

-

Enter Monthly Savings:

Input the amount you plan to save each month towards your pension.

-

Enter Expected Rate of Return:

Provide the annual interest rate or expected rate of return on your savings.

-

Enter Current Pension Savings:

If you already have savings, input the current amount.

-

Calculate:

Click on the calculate button to get your estimated retirement savings and monthly pension income

Example Calculation

| Details | Values |

|---|---|

| {{ row.column1 }} | {{ row.column2 }} |

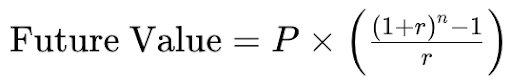

Calculation Formula

The formula to calculate the future value of your pension savings is:

Where:

- P = Monthly savings amount

- r = Monthly interest rate (annual rate divided by 12)

- n = Total number of contributions (number of months until retirement)

Benefits of Using a Pension Calculator

-

Financial Planning

A Pension Calculator is an essential tool for financial planning. It helps you estimate the amount you need to save to achieve your retirement goals, ensuring that you have sufficient funds to maintain your desired lifestyle post-retirement.

-

Set Realistic Goals

By providing a clear projection of your retirement savings, the Pension Calculator allows you to set realistic financial goals. This ensures that you are not under or overestimating the amount needed for a comfortable retirement

-

Compare Investment Options

The calculator allows you to compare different saving and investment options by inputting various rates of return and savings amounts. This helps you choose the best strategy to maximize your retirement savings.

-

Quick and Accurate Results

Manual calculations can be time-consuming and prone to errors. A Pension Calculator provides quick and accurate results, ensuring you have reliable information to make informed decisions.

Factors Affecting Pension Savings

-

Monthly Savings

The amount you save each month is a primary factor affecting your pension savings. Higher monthly savings result in larger retirement funds.

-

Rate of Return

The expected rate of return on your savings significantly impacts the growth of your pension fund. Higher rates of return lead to greater future values.

-

Investment Duration

The length of time you save for your pension plays a crucial role in determining the future value. The longer the investment duration, the higher the returns due to the power of compounding.

Example

Scenario: You start saving ₹15,000 per month at an expected return of 7% per annum for 25 years.

Calculation:

| Investment Duration | Future Value (₹) |

|---|---|

| {{ row.column1 }} | {{ row.column2 }} |

Understanding Compounding in Pension Savings

-

What is Compounding?

Compounding is the process where the earnings from an investment are reinvested to generate additional earnings. This means that the interest earned on the principal amount also earns interest over time, leading to exponential growth.

-

Impact of Compounding on Pension Savings

The effect of compounding is more significant over longer investment periods. By reinvesting the returns, the investment grows at an increasing rate, maximizing the future value.

Compounding Example

Scenario: Saving ₹20,000 per month at an annual return of 8% for 30 years.

Calculation:

| Year | Principal (₹) | Interest (₹) | Future Value (₹) |

|---|---|---|---|

| {{ row.column1 }} | {{ row.column2 }} | {{ row.column3 }} | {{ row.column4 }} |

Types of Pension Plans

-

Defined Benefit Plans

Defined Benefit Plans

-

Defined Contribution Plans

In defined contribution plans, the contributions are defined, but the benefit amount at retirement depends on the investment performance. Examples include the National Pension System (NPS) and Employee Provident Fund (EPF).

-

Personal Pension Plans

Personal pension plans are retirement savings plans that individuals can set up independently. These plans offer flexibility in terms of contribution amounts and investment choices.

-

Annuity Plans

Annuity plans provide a regular income stream during retirement. They can be purchased with a lump sum or through regular contributions and offer options such as immediate or deferred annuities.

How to Choose the Right Pension Plan?

-

Assess Your Retirement Goals

Understanding your retirement goals is crucial when selecting a pension plan. Consider factors such as desired retirement age, lifestyle, and expected expenses.

-

Evaluate Your Risk Tolerance

Different pension plans come with varying levels of risk. Assess your risk tolerance and choose a plan that aligns with your comfort level. For instance, defined contribution plans may offer higher returns but come with market risks.

-

Consider Flexibility and Accessibility

Choose a pension plan that offers flexibility in terms of contribution amounts and access to funds. Some plans allow partial withdrawals or loans against the savings, which can be beneficial in times of need.

-

Compare Costs and Fees

Different pension plans have varying costs and fees. Evaluate the fee structure of each plan, including administrative fees, fund management charges, and withdrawal penalties, to ensure you get the best value.

Frequently asked questions

-

-

A pension calculator uses inputs such as your current age, retirement age, monthly savings, expected rate of return, and current savings to calculate the future value of your retirement savings and estimate your monthly pension income.

-

It helps in financial planning, setting realistic retirement goals, comparing different investment options, and providing quick and accurate projections of your retirement savings.

-

Yes, you can use a pension calculator for various pension plans, including defined benefit plans, defined contribution plans, personal pension plans, and annuity plans.

-

The primary factors affecting your pension savings are the monthly savings amount, rate of return, and investment duration. Additional factors include current savings and any employer contributions

-

Compounding allows your investment to grow exponentially by earning returns on the returns, leading to higher future values over time.

-

Defined benefit plans provide a guaranteed payout at retirement, whereas defined contribution plans have defined contributions, and the benefit amount depends on the investment performance.

-

The amount you need to save depends on your retirement goals, expected expenses, lifestyle, and other income sources. A pension calculator can help you determine the required savings amount.

-

Yes, many pension plans allow you to adjust your contributions over time. This flexibility helps you adapt your savings strategy based on changes in your financial situation.

-

In many countries, contributions to pension plans are tax-deductible, offering tax benefits

-

Get a Personal Loan that fits your needs. Apply for loans from

Rs 1,000 to Rs 15 Lakhs with Lowest Interest Rates.

-

Find the Perfect Credit Card for your spending habits. Explore

Top Credit Cards and maximize your rewards every month.