A Recurring Deposit (RD) is a savings scheme that allows investors to deposit a fixed amount every month for a predetermined period, earning a fixed interest rate.

Invested Amount

Est. Returns

Total Value

{{ $filters.formatCurrency(invested) }}

{{ $filters.formatCurrency(totalReturn) }}

{{ $filters.formatCurrency(totalAmount) }}

RD Calculator Online

A Recurring Deposit (RD) Calculator is a powerful tool designed to help you estimate the future value of your RD investments. By inputting variables such as the monthly deposit amount, interest rate, and investment tenure, you can get an accurate projection of your savings. This helps in making informed decisions and optimizing your investment strategy.

What is a Recurring Deposit (RD)?

A Recurring Deposit (RD) is a popular savings scheme offered by banks and financial institutions in India. It allows investors to deposit a fixed amount every month for a predetermined period, earning a fixed interest rate. At the end of the tenure, the investor receives the principal amount along with the accumulated interest. RD is ideal for individuals looking to build a disciplined saving habit while earning guaranteed returns.

How to Use the RD Calculator?

Using the RD Calculator is simple and straightforward. Follow these steps:-

Enter the Monthly Deposit Amount:

Input the amount you plan to deposit each month in the RD.

-

Enter the Interest Rate:

Provide the annual interest rate for the RD.

-

Enter the Investment Tenure:

Specify the duration of the RD in months or years.

-

Calculate:

Click on the calculate button to get your estimated maturity amount.

| Details | Values |

|---|---|

| {{ row.column1 }} | {{ row.column2 }} |

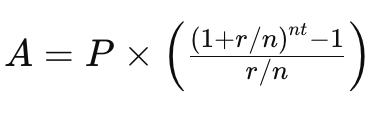

Calculation Formula

The formula to calculate the maturity amount of an RD investment is:

Where:

- A = Maturity amount

- P = Monthly deposit amount

- r = Annual interest rate (in decimal)

- n = Number of times interest is compounded per year

- t = Investment tenure in years

Benefits of Using an RD Calculator

-

Financial Planning

An RD Calculator is an essential tool for financial planning. By projecting the future value of your RD investment, you can set realistic financial goals and create a roadmap to achieve them.

-

Compare Investment Options

The calculator allows you to compare RD with other investment options by inputting various interest rates and tenures. This helps you choose the best investment based on your financial goals and risk appetite.

-

Quick and Accurate Results

Manual calculations can be time-consuming and prone to errors. An RD Calculator provides quick and accurate results, ensuring you have reliable information to make informed decisions.

Factors Affecting RD Returns

-

Monthly Deposit Amount

The amount you deposit each month is a primary factor affecting your returns. Higher monthly deposits result in larger maturity amounts.

-

Interest Rate

The annual interest rate on the RD is a critical determinant of your investment’s growth. Higher interest rates lead to greater future values.

-

Investment Tenure

The length of time you invest in the RD significantly impacts your returns. The longer the investment tenure, the higher the returns due to the power of compounding.

Example

Scenario: You deposit ₹10,000 monthly in an RD at an interest rate of 7% per annum for 3 years.

Calculation:

| Investment Tenure | Maturity Amount (₹) |

|---|---|

| {{ row.column1 }} | {{ row.column2 }} |

Understanding Compounding in RD

-

What is Compounding?

Compounding is the process where the earnings from an investment are reinvested to generate additional earnings. This means that the interest earned on the principal amount also earns interest over time, leading to exponential growth.

-

Impact of Compounding on RD

The effect of compounding is more significant over longer investment periods. By reinvesting the returns, the investment grows at an increasing rate, maximizing the future value.

Compounding Example

Scenario: Depositing ₹5,000 monthly in an RD at an annual return of 6.5% for 5 years.Calculation:

| Year | Principal (₹) | Interest (₹) | Maturity Amount (₹) |

|---|---|---|---|

| {{ row.column1 }} | {{ row.column2 }} | {{ row.column3 }} | {{ row.column4 }} |

Features of Recurring Deposit (RD)

-

Tenure

The RD scheme offers flexible tenure options, typically ranging from 6 months to 10 years, allowing investors to choose a duration that suits their financial goals.

-

Contribution Limits

Investors can choose a monthly deposit amount according to their financial capability. There is no upper limit, but the minimum amount is usually ₹100 per month.

-

Interest Rate

The interest rate on RDs is generally fixed and varies from bank to bank. It is typically higher than the interest rates offered on savings accounts.

-

Premature Withdrawal

RDs offer the option of premature withdrawal, although it may attract a penalty. The interest earned may also be lower than the contracted rate if the RD is withdrawn early.

-

Loan Against RD

Many banks offer the facility to take a loan against the RD balance. This can be useful in times of financial emergencies.

How to Open an RD Account?

-

Visit a Bank or Post Office

RD accounts can be opened at designated bank branches and post offices. Fill out the application form and submit it along with the required documents and the initial deposit.

-

Required Documents

To open an RD account, you need to provide:- Proof of Identity (Aadhaar, PAN card, Passport, etc.)

- Proof of Address (Utility bills, Aadhaar, Passport, etc.)

- Recent passport-sized photographs

-

Modes of Payment

You can make monthly deposits to your RD account through cash, cheque, demand draft, or digital payments via net banking or mobile banking apps.

Conclusion

A Recurring Deposit (RD) Calculator is an indispensable tool for anyone looking to invest in RDs. By providing accurate projections of future returns, it helps in effective financial planning and informed decision-making. Use our RD Calculator to estimate your investment’s future value and maximize your returns. Whether you are planning for a short-term goal or building a long-term savings corpus, understanding how your investments grow can significantly impact your financial success. Start planning your investments today and achieve your financial goals with confidence.

Frequently asked questions

-

-

The RD Calculator estimates the maturity amount of your investment based on the monthly deposit amount, interest rate, and investment tenure.

-

The interest rate for RD varies from bank to bank and is generally higher than the interest rates offered on savings accounts.

-

The minimum tenure for RD is typically 6 months, and the maximum tenure is 10 years.

-

Yes, premature withdrawal is allowed, but it may attract a penalty. The interest earned may also be lower than the contracted rate if the RD is withdrawn early.

-

Yes, the interest earned on RD is taxable. It is added to your income and taxed according to your income tax slab.

-

Yes, many banks offer the facility to take a loan against the RD balance.

-

The interest on RD is compounded quarterly, leading to higher returns due to the effect of compounding.

-

No, the monthly deposit amount is fixed at the time of opening the RD account and cannot be changed.

-

You can check your RD balance by visiting the bank or post office where you have opened the account or through internet banking if your bank offers this facility.

-

Get a Personal Loan that fits your needs. Apply for loans from

Rs 1,000 to Rs 15 Lakhs with Lowest Interest Rates.

-

Find the Perfect Credit Card for your spending habits. Explore

Top Credit Cards and maximize your rewards every month.