Return on Investment (ROI) is a measure of the profitability of an investment, calculated by dividing the net profit by the initial investment and expressed as a percentage.

Investment Gain

ROI

Annualized ROI

{{ $filters.formatCurrency(gain) }}

{{ $filters.formatCurrency(roi) }}%

{{ $filters.formatCurrency(annualRoi) }}%

ROI Calculator Online:

A Return on Investment (ROI) Calculator is a valuable tool for investors and business owners to assess the profitability of their investments. By inputting variables such as the initial investment amount and the final return, the calculator helps you determine the ROI, which is a critical metric for making informed financial decisions.

What is ROI?

Return on Investment (ROI) is a performance measure used to evaluate the efficiency or profitability of an investment. It is calculated by dividing the net profit from an investment by the initial cost of the investment. ROI is expressed as a percentage and is a crucial indicator of financial success.

How to Use the ROI Calculator?

Using the ROI Calculator on Credyfi is straightforward. Follow these steps:-

Enter the Initial Investment Amount:

Input the total amount you have invested.

-

Enter the Final Value of Investment:

Provide the final value of the investment.

-

Calculate:

Click on the calculate button to get your ROI percentage.

Example Calculation

| Details | Values |

|---|---|

| {{ row.column1 }} | {{ row.column2 }} |

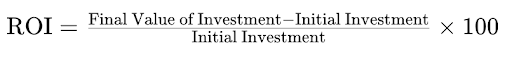

Calculation Formula

The formula to calculate ROI is:

Benefits of Using an ROI Calculator

-

Financial Planning

An ROI Calculator is an essential tool for financial planning. It helps you evaluate the potential profitability of various investment options, enabling you to make data-driven decisions.

-

Compare Investment Options

The calculator allows you to compare different investments by inputting various initial amounts and final returns. This helps you choose the most profitable investment based on your financial goals and risk appetite.

-

Quick and Accurate Results

Manual calculations can be time-consuming and prone to errors. An ROI Calculator provides quick and accurate results, ensuring you have reliable information to make informed decisions.

Factors Affecting ROI

-

Initial Investment Amount

The amount you invest initially is a primary factor affecting your ROI. Higher initial investments typically result in higher absolute returns.

-

Final Value of Investment

The final value of your investment is crucial in determining ROI. This value includes the gains or losses made from the investment.

-

Investment Duration

The length of time you hold an investment can impact ROI. Shorter investment periods might lead to higher annualized returns, while longer periods can offer stability and lower risk.

Example

Scenario: You invest ₹1,00,000 in a business, and after 2 years, the value of your investment grows to ₹1,50,000.

Calculation:

| Initial Investment Amount (₹) | Final Value (₹) | ROI (%) |

|---|---|---|

| {{ row.column1 }} | {{ row.column2 }} | {{ row.column3 }} |

Understanding ROI in Different Contexts

-

Business Investments

For business owners, calculating ROI helps determine the profitability of different projects, marketing campaigns, or product launches. It provides a clear picture of which investments are yielding the best returns.

-

Real Estate Investments

In real estate, ROI helps investors evaluate the profitability of property investments. By considering purchase costs, renovation expenses, and rental income or resale value, investors can make informed decisions.

-

Stock Market Investments

For stock market investors, ROI is used to compare the performance of different stocks or portfolios. It helps in identifying which stocks are providing the best returns relative to their cost.

How to Improve ROI?

-

Increase Revenue

Boosting the final value of your investment by increasing revenue or reducing costs can significantly improve ROI. This can be achieved through better marketing strategies, improved sales techniques, or cost-cutting measures.

-

Reduce Initial Investment

Lowering the initial investment amount while maintaining or increasing the final value can lead to a higher ROI. Negotiating better deals, sourcing cheaper materials, or optimizing operations can help achieve this.

-

Shorten Investment Duration

Reducing the time period of your investment can lead to higher annualized returns. However, this should be balanced with the risk of shorter-term investments.

Example

Scenario: You invest ₹2,00,000 in a stock, and after 1 year, the value of your investment grows to ₹2,50,000.

Calculation:

| Initial Investment Amount (₹) | Final Value (₹) | ROI (%) |

|---|---|---|

| {{ row.column1 }} | {{ row.column2 }} | {{ row.column3 }} |

Conclusion

A Return on Investment (ROI) Calculator is an indispensable tool for investors and business owners looking to assess the profitability of their investments. By providing accurate projections of ROI, it helps in effective financial planning and informed decision-making. Use our ROI Calculator to estimate your investment’s returns and maximize your profitability. Whether you are planning a business project, investing in real estate, or trading in the stock market, understanding how your investments perform can significantly impact your financial success. Start planning your investments today and achieve your financial goals with confidence.

Frequently asked questions

-

-

The ROI Calculator estimates the return on investment based on the initial investment amount and the final value of the investment.

-

A good ROI percentage varies by industry and investment type. Generally, an ROI above 15% is considered good, but this can vary based on the risk and investment horizon.

-

Yes, ROI can be negative if the final value of the investment is less than the initial investment, indicating a loss.

-

ROI specifically measures the profitability of an investment relative to its cost, whereas other metrics like net profit or earnings per share measure absolute profitability.

-

Yes, you can use the ROI Calculator for various investments, including business projects, real estate, and stock market investments.

-

Key factors include the initial investment amount, final value of the investment, and the duration of the investment.

-

ROI should be calculated regularly to assess the performance of your investments and make informed decisions. It is commonly calculated annually or at the end of an investment period.

-

Improving ROI can be achieved by increasing revenue, reducing initial investment costs, and shortening the investment duration.

-

The ROI Calculator provides accurate results based on the input values. However, it is essential to consider other financial metrics and qualitative factors when making investment decisions.

-

Get a Personal Loan that fits your needs. Apply for loans from

Rs 1,000 to Rs 15 Lakhs with Lowest Interest Rates.

-

Find the Perfect Credit Card for your spending habits. Explore

Top Credit Cards and maximize your rewards every month.