Simple Interest is a method of calculating the interest charged on a principal amount over a specific period, without considering compounding.

Principal Amount

Invested Amount

Total Value

{{ $filters.formatCurrency(principle) }}

{{ $filters.formatCurrency(totalInterest) }}

{{ $filters.formatCurrency(totalAmount) }}

Simple Interest Calculator Online

A Simple Interest Calculator is a valuable tool for quickly calculating the interest on a principal amount over a specified period. By inputting the principal amount, interest rate, and time period, you can get an accurate projection of the interest earned or paid. This helps in making informed financial decisions, whether you're borrowing or lending money, or planning investments.

What is Simple Interest?

Simple Interest is a method of calculating the interest charged on a principal amount over a specific period. It is a straightforward way to determine the interest without considering compounding. Simple interest is commonly used for short-term loans, savings accounts, and some types of bonds.

How to Use the Simple Interest Calculator?

Using the Simple Interest Calculator on Credyfi is straightforward. Follow these steps:-

Enter the Principal Amount:

Input the initial amount of money (the principal).

-

Enter the Interest Rate:

Provide the annual interest rate (as a percentage).

-

Enter the Time Period:

Specify the duration for which the interest is calculated (in years).

-

Calculate:

Click on the calculate button to get your interest amount.

Example Calculation

| Details | Values |

|---|---|

| {{ row.column1 }} | {{ row.column2 }} |

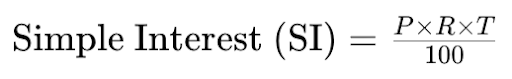

Calculation Formula

The formula to calculate Simple Interest is:

Where:

- P = Principal amount

- R = Annual interest rate

- T = Time period in years

Benefits of Using a Simple Interest Calculator

-

Financial Planning

A Simple Interest Calculator is an essential tool for financial planning. It helps you estimate the interest you will earn or pay over a specified period, enabling you to make informed decisions.

-

Compare Financial Options

The calculator allows you to compare different financial products by inputting various principal amounts, interest rates, and time periods. This helps you choose the best option based on your financial goals and risk appetite.

-

Quick and Accurate Results

Manual calculations can be time-consuming and prone to errors. A Simple Interest Calculator provides quick and accurate results, ensuring you have reliable information to make informed decisions.

-

Principal Amount

The principal amount is the initial sum of money invested or borrowed. A higher principal amount results in higher interest earned or paid.

-

Interest Rate

The annual interest rate determines how much interest you will earn or pay on the principal amount. Higher interest rates lead to greater interest amounts.

-

Time Period

The time period is the duration for which the interest is calculated. Longer time periods result in higher interest amounts.

Example

Scenario: You invest ₹20,000 at an interest rate of 6% per annum for 5 years.

Calculation:

| Principal Amount (₹) | Interest Rate (%) | Time Period (years) | Interest Amount (₹) |

|---|---|---|---|

| {{ row.column1 }} | {{ row.column2 }} | {{ row.column3 }} | {{ row.column4 }} |

Understanding Simple Interest in Different Contexts

-

Personal Loans

Simple interest is often used in personal loans to calculate the interest payable over the loan tenure. It provides a clear picture of the total interest cost, helping borrowers manage their finances better.

-

Savings Accounts

Some savings accounts use simple interest to calculate the interest earned on deposits. This helps savers understand how much interest they will earn over a specific period.

-

Bonds and Investments

Simple interest is used in certain bonds and investment products to calculate the interest earned. This helps investors evaluate the potential returns on their investments.

How to Maximize Returns with Simple Interest?

-

Increase the Principal Amount

Investing a larger principal amount can significantly increase the interest earned. Ensure you have a substantial principal to maximize your returns.

-

Opt for Higher Interest Rates

Choosing financial products with higher interest rates can lead to greater interest earnings. Compare different options to find the best rates.

-

Extend the Time Period

Extending the time period for which the interest is calculated can increase the total interest earned. However, ensure that the investment duration aligns with your financial goals.

Example

Scenario: You invest ₹15,000 at an interest rate of 7% per annum for 4 years.

Calculation:

| Principal Amount (₹) | Interest Rate (%) | Time Period (years) | Interest Amount (₹) |

|---|---|---|---|

| {{ row.column1 }} | {{ row.column2 }} | {{ row.column3 }} | {{ row.column4 }} |

Conclusion

A Simple Interest Calculator is an indispensable tool for anyone looking to calculate interest quickly and accurately. By providing reliable projections of interest amounts, it helps in effective financial planning and informed decision-making. Use our Simple Interest Calculator on Credyfi to estimate your interest and maximize your returns. Whether you are managing personal loans, savings accounts, or investments, understanding how interest works can significantly impact your financial success. Start planning your finances today and achieve your financial goals with confidence.

Frequently asked questions

-

-

The Simple Interest Calculator estimates the interest amount based on the principal amount, interest rate, and time period.

-

The key factors are the principal amount, interest rate, and time period.

-

Yes, you can use it for personal loans, savings accounts, bonds, and various other financial products to calculate the interest.

-

Yes, you can use it for personal loans, savings accounts, bonds, and various other financial products to calculate the interest.

-

You should calculate Simple Interest whenever you want to evaluate the interest earned or payable on a financial product over a specified period.

-

To maximize returns, increase the principal amount, opt for higher interest rates, and extend the time period for which the interest is calculated.

-

Yes, the calculator provides accurate results based on the input values, ensuring reliable information for informed decision-making.

-

No, Simple Interest cannot be negative. It is always a positive value representing the interest earned or payable.

-

Simple Interest is calculated on the principal amount only, while Compound Interest is calculated on the principal amount and the accumulated interest over previous periods.

-

Get a Personal Loan that fits your needs. Apply for loans from

Rs 1,000 to Rs 15 Lakhs with Lowest Interest Rates.

-

Find the Perfect Credit Card for your spending habits. Explore

Top Credit Cards and maximize your rewards every month.