A Systematic Investment Plan (SIP) is an investment strategy where investors contribute a fixed amount regularly into mutual funds or other investment vehicles.

SIP Calculator

Invested Amount

Est. Returns

Total Value

{{ $filters.formatCurrency(invested) }}

{{ $filters.formatCurrency(totalReturn) }}

{{ $filters.formatCurrency(totalAmount) }}

SIP Returns Calculator Online

A Systematic Investment Plan (SIP) Returns Calculator is a valuable tool for investors looking to estimate the returns on their SIP investments. By inputting variables such as the monthly investment amount, interest rate, and investment period, you can get an accurate projection of your investment’s future value. This helps in making informed decisions and optimizing your investment strategy.

What is a Systematic Investment Plan (SIP)?

A Systematic Investment Plan (SIP) is a disciplined investment strategy where investors contribute a fixed amount regularly (monthly, quarterly, etc.) into mutual funds or other investment vehicles. SIPs help investors build wealth over time by averaging out market volatility and benefiting from the power of compounding.

How to Use the SIP Returns Calculator?

Using the SIP Returns Calculator on Credyfi is straightforward. Follow these steps:-

Enter the Monthly Investment Amount:

Input the amount you plan to invest each month in the SIP.

-

Enter the Expected Rate of Return:

Provide the annual interest rate (expected return) for the SIP.

-

Enter the Investment Duration:

Specify the duration of the SIP in months or years.

-

Calculate:

Click on the calculate button to get your estimated future value and total returns.

Example Calculation

| Details | Values |

|---|---|

| {{ row.column1 }} | {{ row.column2 }} |

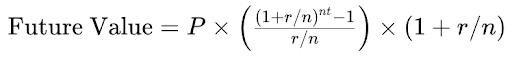

Calculation Formula

The formula to calculate the future value of an SIP investment is:

Where:

- P = Monthly investment amount

- r = Annual interest rate (in decimal)

- n = Number of times interest is compounded per year (usually 12 for monthly SIPs)

- t = Investment tenure in years

Benefits of Using an SIP Returns Calculator

-

Financial Planning

An SIP Returns Calculator is an essential tool for financial planning. By projecting the future value of your SIP investment, you can set realistic financial goals and create a roadmap to achieve them.

-

Compare Investment Options

The calculator allows you to compare different SIP plans by inputting various investment amounts, rates of return, and durations. This helps you choose the best SIP plan based on your financial goals and risk appetite.

-

Quick and Accurate Results

Manual calculations can be time-consuming and prone to errors. An SIP Returns Calculator provides quick and accurate results, ensuring you have reliable information to make informed decisions.

Factors Affecting SIP Returns

-

Monthly Investment Amount

The amount you invest each month is a primary factor affecting your returns. Higher monthly investments result in larger maturity amounts.

-

Interest Rate

The expected annual interest rate on the SIP is a critical determinant of your investment’s growth. Higher interest rates lead to greater future values.

-

Investment Duration

The length of time you invest in the SIP significantly impacts your returns. The longer the investment duration, the higher the returns due to the power of compounding.

Example

Scenario: You invest ₹10,000 monthly in an SIP at an expected return of 10% per annum for 15 years.

Calculation:

| Investment Duration | Maturity Amount (₹) |

|---|---|

| {{ row.column1 }} | {{ row.column2 }} |

Understanding Compounding in SIP

-

What is Compounding?

Compounding is the process where the earnings from an investment are reinvested to generate additional earnings. This means that the interest earned on the principal amount also earns interest over time, leading to exponential growth.

-

Impact of Compounding on SIP

The effect of compounding is more significant over longer investment periods. By reinvesting the returns, the investment grows at an increasing rate, maximizing the future value.

Compounding Example

Scenario: Investing ₹5,000 monthly in an SIP at an annual return of 12% for 20 years.

Calculation:

| Year | Principal (₹) | Interest (%) | Future Value (₹) |

|---|---|---|---|

| {{ row.column1 }} | {{ row.column2 }} | {{ row.column3 }} | {{ row.column4 }} |

Features of Systematic Investment Plans (SIPs)

-

Flexibility

SIPs offer flexibility in terms of investment amounts and frequencies. You can choose to invest monthly, quarterly, or even yearly, based on your financial situation.

-

Rupee Cost Averaging

SIPs benefit from rupee cost averaging, which means you buy more units when prices are low and fewer units when prices are high. This reduces the average cost per unit over time.

-

Disciplined Savings

SIPs encourage disciplined savings by automating the investment process. Regular investments help in building a substantial corpus over time.

-

Diversification

Investing in mutual funds through SIPs provides diversification, as your money is spread across various assets, reducing risk.

-

Professional Management

SIPs in mutual funds are managed by professional fund managers who have the expertise to make informed investment decisions, ensuring optimal returns.

How to Maximize Returns with SIP?

-

Start Early

Starting your SIP investments early allows you to benefit from the power of compounding, leading to significant wealth accumulation over time.

-

Increase Investment Amount Gradually

As your income grows, gradually increase your SIP investment amount to maximize returns. This helps in accelerating your wealth-building process.

-

Stay Invested for the Long Term

SIPs are best suited for long-term investments. Staying invested for a longer duration helps in averaging out market volatility and maximizing returns.

Example

Scenario: You invest ₹8,000 monthly in an SIP at an expected return of 10% per annum for 10 years.

Calculation:

| Investment Duration | Maturity Amount (₹) |

|---|---|

| {{ row.column1 }} | {{ row.column2 }} |

Frequently asked questions

-

-

The SIP Returns Calculator estimates the future value of your SIP investment based on the monthly investment amount, expected rate of return, and investment duration.

-

The formula is: Future Value=P×((1+r/n)nt−1r/n)×(1+r/n)\text{Future Value} = P \times \left( \frac{(1 + r/n)^{nt} - 1}{r/n} \right) \times (1 + r/n)Future Value=P×(r/n(1+r/n)nt−1)×(1+r/n), where PPP is the monthly investment amount, rrr is the annual interest rate, nnn is the number of times interest is compounded per year, and ttt is the investment tenure in years.

-

The key factors are the monthly investment amount, expected rate of return, and investment duration. rious other financial products to calculate the interest.

-

Yes, you can use it for various mutual funds to estimate the returns based on the specific fund's expected rate of return.

-

You should calculate SIP returns regularly to monitor the performance of your investments and make informed decisions.

-

To maximize returns, start early, increase your investment amount gradually, and stay invested for the long term.

-

Yes, the calculator provides accurate results based on the input values, ensuring reliable information for informed decision-making. ng reliable information for informed decision-making.

-

SIP returns can be negative in the short term due to market volatility, but they typically average out and become positive over the long term.

-

SIP involves regular investments over time, while lump-sum investment is a one-time investment. SIPs benefit from rupee cost averaging and disciplined savings, while lump-sum investments can take advantage of market timing.

-

Get a Personal Loan that fits your needs. Apply for loans from

Rs 1,000 to Rs 15 Lakhs with Lowest Interest Rates.

-

Find the Perfect Credit Card for your spending habits. Explore

Top Credit Cards and maximize your rewards every month.