Yes, you can enroll in APY even if you have an NPS account, as they are separate schemes.

APY Calculator

Monthly Investment

Investment Duration

Total Amount

{{ $filters.formatCurrency(this.monthlyInvestment) }}

{{ this.investmentDuration }}Years

{{$filters.formatCurrency(this.totalAmount) }}

What is Atal Pension Yojana Calculator?

Planning for retirement might seem like a distant concern, but the

sooner you start, the better off you'll be. One of the most

effective tools for retirement planning in India is the Atal

Pension Yojana (APY).

This government-backed scheme ensures that you have a stable

pension to rely on once you retire. But how do you know how much

to contribute and what pension you can expect? That's where the

Atal Pension Yojana Calculator comes in handy.

What is the Atal Pension Yojana (APY)?

The Atal Pension Yojana, launched in 2015, is a pension scheme aimed at the unorganized sector workers. Named after the former Prime Minister of India, Atal Bihari Vajpayee, the scheme's primary objective is to provide a fixed pension to workers after they reach 60 years of age, thus ensuring their financial security in their twilight years.

Features of Atal Pension Yojana

-

Guaranteed Minimum Pension

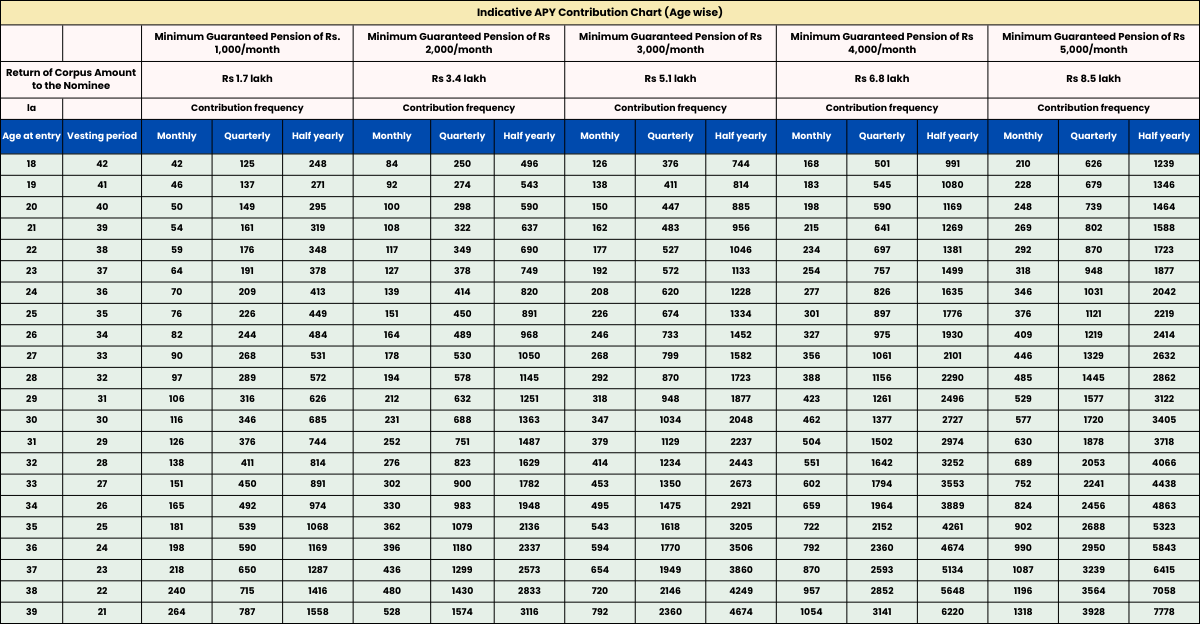

One of the standout features of APY is the guaranteed minimum pension that ranges from ₹1,000 to ₹5,000 per month, depending on the contribution amount and the age at which you start contributing.

-

Contribution and Pension Slabs

Participants can choose from various pension slabs, and their contributions are determined accordingly. The amount you contribute monthly depends on the pension amount you aim to receive.

-

Government Co-contribution

To encourage participation, the government contributes 50% of the total contribution or ₹1,000 per annum, whichever is lower, for eligible subscribers for the first five years.

Eligibility Criteria for Atal Pension Yojana (APY)

-

Age Limit

APY is open to all citizens of India aged between 18 and 40 years. The earlier you start, the lower your monthly contributions will be.

-

Bank Account Requirement

To enroll in APY, you need to have a savings bank account in any nationalized bank. The contributions are auto-debited from this account.

-

Enrolment Process

The enrolment process is straightforward. Visit your bank, fill out the APY registration form, and submit it along with the required documents.

You can also do it through your netbanking account for most of the banks. Check your netbanking account before visiting the bank.

How Does the APY Calculator Work?

-

Purpose of the APY Calculator

The APY calculator is designed to help you determine the monthly contributions required for your desired pension amount. It simplifies the planning process by providing accurate estimates based on your age and desired pension.

-

Inputs Required for Calculation

To use the APY calculator, you need to input your age, the pension amount you wish to receive, and the tenure of your contributions.

Using the APY Calculator

-

Step-by-Step Guide to Using the Calculator

1. Visit the APY calculator page.

2. Enter your age.

3. Select your desired monthly pension amount.

4. The calculator will display the monthly contribution required. -

Understanding the Results

The results will show you the exact amount you need to contribute every month to achieve your desired pension. It also provides insights into the total contributions over the years.

Benefits of Using the APY Calculator

-

Accurate Pension Estimation

The APY calculator provides precise estimates, allowing you to plan your finances better.

-

Easy Planning for Contributions

Knowing the exact contribution amount helps in budgeting and ensures you meet your retirement goals without any financial strain.

Calculating Your Pension: An Example

Let's say you are 30 years old and aim to receive a monthly pension of ₹3,000. By entering these details into the APY calculator, you might find that your monthly contribution needs to be ₹347. This simple calculation aids in understanding and planning your contributions effectively.

Factors Affecting Your APY Pension

-

Contribution Amount

The higher your monthly contribution, the higher your pension will be.

-

Age at the Time of Enrolment

Younger enrollees benefit from lower contribution amounts for the same pension, compared to those who start later.

-

Tenure of Contribution

A longer tenure results in higher returns due to the compounding effect over the years.

Comparison with Other Pension Schemes

-

APY vs. National Pension Scheme (NPS)

While both schemes aim to provide retirement security, NPS offers market-linked returns, which can be higher but come with risks. APY, on the other hand, offers a guaranteed minimum pension.

-

APY vs. Employee Provident Fund (EPF)

EPF is mandatory for salaried employees in the organized sector, providing a lump sum at retirement, whereas APY is a voluntary scheme targeting the unorganized sector with a regular pension

Maximizing Your Benefits Under APY

-

Tips for Higher Pension Returns

Start early, contribute regularly, and choose a higher pension slab if possible.

-

Importance of Timely Contributions

Make sure your bank account has sufficient balance for the auto-debit of contributions to avoid penalties.

Conclusion :

The Atal Pension Yojana calculator is an invaluable tool for anyone looking to secure their retirement. By providing accurate estimates of the required contributions and potential pension, it simplifies the planning process and helps ensure a stable financial future. Don't wait until it's too late—start using the APY calculator today and take the first step towards a comfortable retirement

Frequently asked questions

-

-

Contributions are usually made monthly, but you can also opt for quarterly or half-yearly contributions.

-

The minimum contribution amount varies based on the age of enrolment and the desired pension, starting as low as ₹42 per month.

-

Yes, APY is linked to your bank account, making it easily transferable irrespective of job or location changes.

-

Premature withdrawal is permitted only in exceptional cases such as terminal illness or death. In other cases, exiting before 60 years will result in the account being closed, and the contributions made will be returned.

-

Yes, you can enroll in APY even if you have an NPS account, as they are separate schemes.

-

Contributions are usually made monthly, but you can also opt for quarterly or half-yearly contributions.

-

The minimum contribution amount varies based on the age of enrolment and the desired pension, starting as low as ₹42 per month

-

Yes, APY is linked to your bank account, making it easily transferable irrespective of job or location changes.

-

Premature withdrawal is permitted only in exceptional cases such as terminal illness or death. In other cases, exiting before 60 years will result in the account being closed, and the contributions made will be returned.

-

Get a Personal Loan that fits your needs. Apply for loans from

Rs 1,000 to Rs 15 Lakhs with Lowest Interest Rates.

-

Find the Perfect Credit Card for your spending habits. Explore

Top Credit Cards and maximize your rewards every month.